In November, 15 Asian countries, comprising 30% of global GDP, signed the Regional Comprehensive Economic Partnership (RCEP), creating a free-trade zone among the signatories. This agreement attempts to provide gains to trading within the regional partnership through reduction of trade and investment barriers, and increased incentives for economic integration. It is noteworthy that RCEP came about without participation of either the U.S. or Europe, and has effectively created the world’s largest trading bloc, according to the Rand Corp. Beyond the obvious benefits for economic growth in the region, a more-subtle byproduct of this agreement is to focus on bilateral settlement of trade, effectively removing the dollar as the standard unit of transaction for regional trade, according to economist and geopolitical analyst Peter Koenig, a veteran of more than 30 years with the World Bank. Liu Xiaochun, deputy dean of the Shanghai New Finance Research Institute, recently furthered this idea, stating, “Under RCEP, currency choices for regional settlement in trade, investment and financing will increase significantly for the yuan, yen, Singapore dollar and Hong Kong dollar.” Liu’s comments were posted to the China Finance 40 Forum, a think tank comprising senior Chinese regulatory officials and financial experts.

Asia is not the only region taking steps to disentangle itself from the U.S. dollar standard in global trade and payments. The European Commission, the executive branch of the 27-country European Union (EU), released a communication explicitly stating the goal to strengthen the “international role of the euro.” This goal would “help achieve globally shared goals such as the resilience of the international monetary system, a more stable and diversified global currency system, and a broader choice for market operators.”5 The communication also highlights the use of sanctions by other countries, which hurt domestic EU interests, as an additional reason for taking action to make the EU more autonomous in the global trade-and-payments infrastructure. This document outlines specific action items to help move the EU in this direction of more autonomy from the current dollar-centric system. The implementation of a digital finance strategy will be a key component of this new EU strategy, including work on a retail central bank digital currency available to the general public.

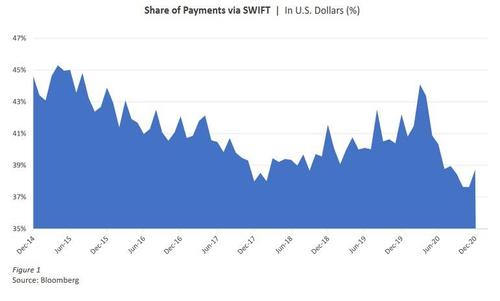

The Society for Worldwide Interbank Financial Telecommunication (SWIFT), the largest global payment settlement network, has already experienced drop-off in dollar transactions in its most-recent readings. It is interesting that this occurred after the implementation of RCEP, although the timing also comes in the wake of the COVID-19 pandemic and resulting economic disruptions.

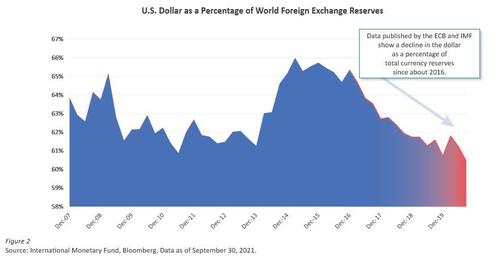

An additional element to watch will be the allocation of global central banks’ foreign currency reserves to the dollar. Non-dollar currencies recently have strengthened as the dollar has sold off. This has given many nations the opportunity to start to intervene to help stop the appreciation of their currencies and to rebuild their reserves buffers. Historically, the bulk of international reserves has been in the dollar. Today, a close eye should be kept on these allocations. If holdings in the U.S. currency decrease as a percentage of the total currency reserves while non-U.S. countries are building those reserves, that could mark a significant change in their behavior. In fact, perhaps such a deliberate policy change might have already begun. Data published by the European Central Bank (ECB) and the International Monetary Fund (IMF) show a decline in the dollar as a percentage of total currency reserves since about 2016.

Font: https://www.infowars.com/posts/financial-firm-warns-events-in-motion-to-remove-dollar-as-reserve-currency/