StraitShot47

Member

- Joined

- Sep 20, 2017

- Messages

- 745

TARP was $435 billion, but don't call this quantitative easing.

The FED Reserve is pumping around $190 billion every day into the REPO market. Don't mistake REPO for repossession like they do to a car. In economic terms REPO means repurchase agreements, usually overnight and repaid the next day.

The FED comes in, buys treasuries and mortgage backed securities from these central banks. This is known as open market operations. Now you're thinking why is this bad?

It's bad because they're monetizing the debt. When governments, who create their own currency, need to run a deficit they create bonds. They sell these bonds NOT to your average joe like war bonds of old. They sell the bonds to certain central banks called "primary dealers", and these dealers HAVE TO bid on the debt.

These banks are over saturated in US debt, and don't have the liquidity to run their day to day operations. The banks can't sell the bonds on the open market because it will add to the supply thus decreasing the price. The banks go to the FED, put their treasuries and mortgage backed securities up as collateral, and then the FED gives the banks a loan.

The FED Reserve doesn't have this money, so it must expand it's balance sheet. Which means it just creates money out of nothing, all it is just key strokes on a computer. So now the FED has these treasuries and mortgage backed securities which accrues interest or matures, and just remits that back to the Treasury. Isn't that fucked?

Why is this disconcerting?

1) What happened to the trillions of QE1, QE2, QE3? Why is there a liquidity crisis in money markets?

2) Are the bankers just refilling their pockets? Are they enriching themselves?

3) is there a bank or banks failing? Did they try to short precious metals along with paper contracts and now since prices are rising are they screwed?

4) Are these permanent operations? Eroding confidence? Paving the way for MMT?

5) Will there be inflation? Pension crisis leading to hyper inflation? Weimar Republic here we come?

6) how do you price find in real estate or the stock market with this much intervention? How do you find appropriate asset prices?

Here's youtube channels which focus on economics the main stream neglects to mention;

https://m.youtube.com/user/usawatchdog

https://m.youtube.com/user/GregVegas5909

https://m.youtube.com/user/itmtrading

https://m.youtube.com/channel/UCAvSnci_3qHF_7c2LQnP_wg

https://m.youtube.com/channel/UCJ-qLG1bdWVrHM-Hu2W73CQ

https://m.youtube.com/channel/UCBH5VZE_Y4F3CMcPIzPEB5A

https://www.newyorkfed.org/newsevents/speeches/2019/log191104

The FED Reserve is pumping around $190 billion every day into the REPO market. Don't mistake REPO for repossession like they do to a car. In economic terms REPO means repurchase agreements, usually overnight and repaid the next day.

The FED comes in, buys treasuries and mortgage backed securities from these central banks. This is known as open market operations. Now you're thinking why is this bad?

It's bad because they're monetizing the debt. When governments, who create their own currency, need to run a deficit they create bonds. They sell these bonds NOT to your average joe like war bonds of old. They sell the bonds to certain central banks called "primary dealers", and these dealers HAVE TO bid on the debt.

These banks are over saturated in US debt, and don't have the liquidity to run their day to day operations. The banks can't sell the bonds on the open market because it will add to the supply thus decreasing the price. The banks go to the FED, put their treasuries and mortgage backed securities up as collateral, and then the FED gives the banks a loan.

The FED Reserve doesn't have this money, so it must expand it's balance sheet. Which means it just creates money out of nothing, all it is just key strokes on a computer. So now the FED has these treasuries and mortgage backed securities which accrues interest or matures, and just remits that back to the Treasury. Isn't that fucked?

Why is this disconcerting?

1) What happened to the trillions of QE1, QE2, QE3? Why is there a liquidity crisis in money markets?

2) Are the bankers just refilling their pockets? Are they enriching themselves?

3) is there a bank or banks failing? Did they try to short precious metals along with paper contracts and now since prices are rising are they screwed?

4) Are these permanent operations? Eroding confidence? Paving the way for MMT?

5) Will there be inflation? Pension crisis leading to hyper inflation? Weimar Republic here we come?

6) how do you price find in real estate or the stock market with this much intervention? How do you find appropriate asset prices?

Here's youtube channels which focus on economics the main stream neglects to mention;

https://m.youtube.com/user/usawatchdog

https://m.youtube.com/user/GregVegas5909

https://m.youtube.com/user/itmtrading

https://m.youtube.com/channel/UCAvSnci_3qHF_7c2LQnP_wg

https://m.youtube.com/channel/UCJ-qLG1bdWVrHM-Hu2W73CQ

https://m.youtube.com/channel/UCBH5VZE_Y4F3CMcPIzPEB5A

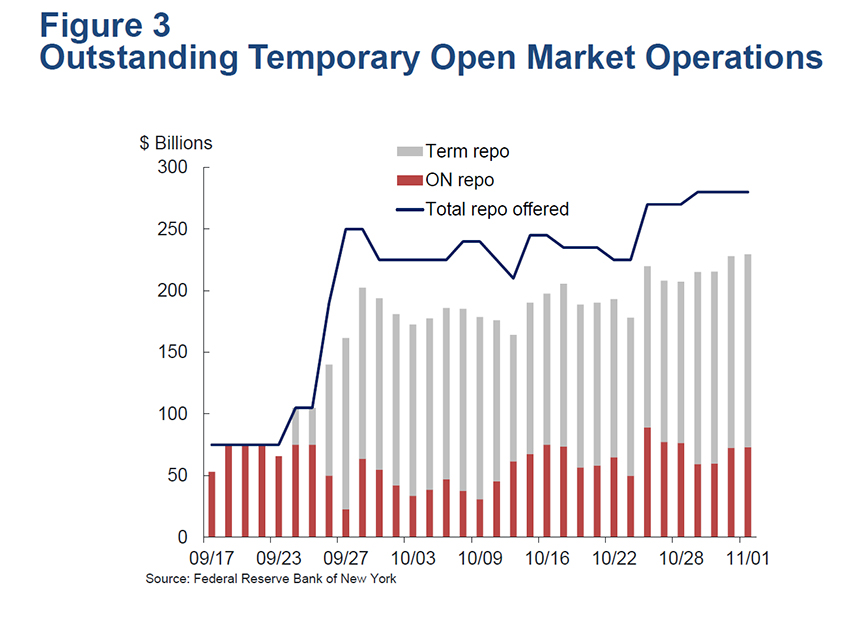

First, reserve management purchases will replace over time the reserves that repo operations are currently supplying. In October, overnight and term repo operations together resulted in a daily average of around $190 billion in total repos outstanding (Figure 3). In the near term, these operations have boosted the supply of reserves and helped to mitigate the risk of money market pressures adversely affecting monetary policy implementation

https://www.newyorkfed.org/newsevents/speeches/2019/log191104