Latest News

Welcome to Our New Forums

- Our forums have been upgraded! You can read about this HERE

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2019 economy

- Thread starter Aquarius

- Start date

The thing is we have these vain prophets who constantly saying about a pathetic repeating meme of "crashing economy" for years now, decades and centuries at large, because either they would like it to crash, or they buy all the fear mongering on the jews. Year after year, the economy is about to collapse, the world is about to end, WW3 is going to arrive at anytime.

A part of this, sometimes, it's real and valid of a concern. But the majority of these things always tend to be bogus. Astrologically speaking, Uranus is now in Taurus, which shows a modernization, and also change and possible reformation of the current financial status of this world. This can be for the better, or for the worse, but this influence will be upon this world for around 8 years.

The Entry of Uranus here happens around 2020, which is why many people are expecting some sort of change, which of course, most astrologers and most people are looking with suspicion or the usual paralyzing fear. When Uranus was entering Aries, people were also afraid of WW3, which indeed, was sometimes a possibility, but guess what, it didn't really happen. The answer here is that one cannot know for certain as the lives and existence of many is on the line and there is can be no answer directly here. As far as the spiritual aspect goes here our work is in line helping the situation of the world out and as always there is a juking out of where this so called 'system' is going. Uranus rules over unpredictability, but in general, Uranus also can help with revitalization and changing things for the better, not necessarily for the worst.

Predicting some bad event MAY happen in 8 years, is as if predicting it's going to rain once is Zimbabwe within the next 8 months. If it happens, then you are a prophet! If not, it's all fine - just prophesize against next tommorow, and for the next thousands of days until it rains. And when it does actually happen, make it real loud and proclaim "My holy predictions were right!".

If you constantly buy on this hype, and you do not look at life and choices with defiance, you will be permanently a slave. The people who engage in this foolish mentality are clearly lacking spiritual insight and are spiritually blind.

Out of all these millions of so called 'predictions', only one is correct. And the only ones who really will know are those who are experienced in risk taking, or really deeply into finances, or otherwise, have other actual premonitions of these things, and not yet another alarm for these every year. Every single month there is a report on the economy that is about to crash RIGHT NOW!

A specific type of born slaves people are fetishistic around these events. They just wish their life will be ended by some sort of comet, or that the economy will drop and kill them. They have wet dreams on visions of people running and crawling in the government to give them a loaf of bread, and they fantasize that these situations are good for revolutions or social change. The reality is however, when humanity sinks on the level of seeking a molded loaf of bread, the majority is done, civilization starts sinking. Depending on the type of civilization, the sinking can be rapid and deadly.

The doomsday prophets fetishize even harder. Maybe finally the Lord will come to save them? Are we the Chosen on the Final Days? Have we Repented enough?

It's as if they want the economy destroyed so they can prove their shitty dreams or "predictions" correct. "I predicted this 100 different times and failed, but this time I was correct, obey the prophet of the lord! For he knew how to predict a collapse, but he didn't know shit on how to avert it or WTF to do during it".

Others do get paid to write lies in regards to said collapses, wars that won't happen, endless bogus crap, and constantly re-affirm on the goyim how futile, pointless, and impossible is any form existential ascent. Do not have children goyim, for your societies will go down anyway. Do not have a relationship goyim, for love dies. Do not breathe air goyim, for you will die anyway. Finding and competing for a job that is good for you and trying to build a future for yourself? Why bother? This system will enslave you!

It is of thine enemy the Pharisee, saith Rabbi Yeshua. It is rigged! The old laws of willpower, spirituality, and mastery, have all but perished! Woe to us, goyim.

They act like Jesus on the mount whining about his racial cousins (and covering for) the "Pharisees", their financial power and wealth.

This very same whiny behavior is also what is creating jews wealth and power since forever. For the rich jew, you need poor goyim to exist.

The reality is that on said events, there can be no real or actual prediction, except if one is very deep in the know.

Nobody really knows 'when' and 'if' an economy is going to crash. The economy can be kept going, and there are no factors to actually 'crash' it that are the given. We are not in 1929, and most people's brains are still stuck in 1929. The economy is so artificial and so globalized it doesn't just drop by coincidence anymore, and can be kept going. The thing that is consistent is bubbles, and what do we mean by bubbles? False and unfounded investments and money going to disappear into a black hole.

Other than that, we are not a Forex group, nor an investment firm to give you financial advice. Maybe the doomsayers can give you some advice such as in the bible: "Sell all your possessions, and follow the lord! For it's easier than a hobo to reach heaven than the camel to go through the eye of the needle! Sell your homeless cart today, for it's the possession of a Gentile Sinner, and donate all 10 bucks from it to Jesus's Church so he can save you from the Pharisees and his racial cousins!".

If you want a personal statement, fuck what all these people who shit their pants say, and do what you have to do, as life involves risks. In the event that the economy dropped, your funds invested or not, wouldn't be in equally a good situation. You just have to be real careful in what you are investing, and making sure that any investment is realistic, and founded. Investments can fail, but this is like anything else, if you do not try, you will fail one hundred percent. If you do, you may actually succeed.

For example, the investment of a power generator costing 300$ today, would be a far better investment than an investment done in a murky time or environment. Indeed, this power generator turns into a savior under different circumstances, better than Christ who can't heal the flu.

People who are generally losers or do not have skills to do particular things, make sure to raise giant walls for other people. A person sucks in love, they preach the failure and futility of love. The miserable are also the greatest all knowing you will ever meet. They KNOW everything, but with all this knowledge, they are still worthless. Pity to the stupid ones, like us, who do not have their mighty knowledge! For if we had their knowledge we would also be...worthless.

Jews constantly lie of crashing economy so that no goyim invests or does anything in that regard. Prior to that they constantly said that when every goyim makes a fap, the world is going to end. "All is vanity, remain in shit forever, and wait the Lord Savior!". "The End is Coming!". "Its already here!".

What does happen on so called 'economic collapses' also? Jews and others in the know, do profit. As others fall, so do others rise, and this is the nature of this system.

If economics are vanity, then why do the jews invest hardcore, build hardcore wealth, while the goyim are waiting for "Holy Collapse" and shitting in their own pumpers and pretending the holiness of broke "Christos", the wretched hero, on whose name was built the greatest and richest criminal mafia which would make all mafias of the history of the world pale and look like innocent children.

"Wars and Rumors of Wars", "Kikes spreading the rumors of kikes", is the statement here.

What you have to do is your personal responsibility, and so is any other choice in life.

Below I am re-posting a sermon I have done on the subject:

____

Wealth: Jews Vs Gentiles

Mon Jul 10, 2017 10:00 pm High Priest Hoodedcobra666

I wanted to write something about this, to share some Truths known to all jews and the enemy, but these are vaguely known to any of others who are Cattle and "Goyim" by definition.

One thing we observe when we read this 2000 page book that is called the Bible (depending on the printing, normally has around 1500), we see some things that we can understand deeply. Excellent book to double speak, lie, and always find something to justify just about everything from. "The Word of God". This "God" is a real weasel, but guess why? Because it's nothing but a jewish racial projection and nothing else. OF course, most teachings are NOT contained in the bible at all, which brings us into innumerable pages.

The Old Testament, is what the Jews favor and is their crown jewel. This is their "Torah", however in a greater Torah, they also have other books. The Torah is a body of teachings, not just the Old Testament, but the Old Testament is the core of the magickal book. To be swift and not brush of the point to readers, I'll get to the point.

This book named the Old Testament, is chock filled with:

Blessings of wealth without doing anything, also known as parasitism (Proverbs 10:22), prosperity, Scamming other nations after causing massive war for financial gain(Zechariah 14:14), even if people give financial benefits to the jews they are to be killed anyway (Exodus 11:5), advice how to give and take money, always telling jews to take care financially of other jews such as not charging any interest (Deuteronomy 23:19), financial advice (Psalm 112:5), financial relationships advice between members of the jewish tribe (Leviticus 25:35-37), showing how to scam the Non Jews (Deuteronomy 23:19-20), how wealth belongs to the jewish 'god; and subsequently to the Jewish race (Haggai 2:8), how the jewish god gives wealth (Deuteronomy 8:18), advice on how to grow wealth (Proverbs 13:11), 'promises by god' to 'lend to nations' as a blessing (Deuteronomy 15:6), how you should take false oaths as a jew and never pay back debts (to Goyim - Ecclesiastes 5:5), the Jew is supposed to kill even those who housed them simply because those who housed them may be richer than the jews or make them work (Isaiah 19)...

This is a magickal spell book that has countless spells about prosperity for the jews, damning the prosperity of the Gentiles, creating impoverishment and profiting from it, taking the highest social position in Gentile lands (The whole story of Joseph in Genesis, the Jew who betrayed Egypt, includes all the above), how to marry to infiltrate and take over races and when not to (1 Kings 2:21), how the jews should always remain racially loyal and pure of blood and kill race traitors(1 Kings 2:24), and it even has all sorts of

other things such as laws on how to lend money to Gentiles and to jews (Exodus 22:25), how your race-kin family and race are the most important thing in the world (Jeremiah 33:17-18), how you should NEVER believe in the Gods of the Gentiles (Exodus 20:3), how there is a STRICT social order that the jews need to follow in order to succeed, how they must always remember that their relation to their 'god' is racial (Leviticus 26:42). These are to name a few.

On the same book, that Christians worship, put their hands upon and take oaths, gloat and glorify, we have what is called the New Testament. This was written many thousands of years later for the guillible Goyim.

Jesus was a replacement, mimic jewish infiltrator deity, to hijack and replace the Pagan Gods. And preach the exact reverse in order to kill us all.

Now however, this part of the "Scripture" is for the Goyim, the Gentiles, the animals of the field. So what this book writes is simple.

How supposedly "Wealth" is so AGAINST "Spirituality" (Matthew 6:24), how if you supposedly serve money you can't serve God (so leave this to the jews Goyim - Luke 16:13-15), How you should lend your ENEMIES -like the jews- (Luke 6:35), Curses for the Rich Gentiles (James 5:1-6), How there is no race and how we are all equals to 'god', how you should always share what you have even when you don't have anything, how you should gloat over and eternally worship the jewish "God" while FROWNING and CURSING your own Gods and not worshiping them either (1 Corinthians 10:20-21), how you should give your money for the jews in churches even if you don't have to survive (Mark 12:41-44), how you should be against all wealth posessions because it's greed (Luke 12:15), how one should hate wealth since it's a "Jewish Thing" practiced by the Jewish Pharisees and never the Goyim should practice anything similar (Matthew 21:12), how the "Love of Money is the Root of all Evil" (1 Timothy 6:10), wealth is destructive (1 Timothy 6:9), how you need to sell your possessions to follow a fictitious rabbi that never existed (Matthew 19:21), how you need to give up thoughts of survival and managing or amassing any amount of wealth whatsover (Matthew 6:19–20), how you need to leave and desert your family (Luke 14:26), how you need to get USED TO BEING SCAMMED and BE ROBBED (Luke 6:30), how you should give not a fuck about any social order and only trust Jesus Christ as "Authority" (Galatians 3:28), the earth nor the planet matters one dime neither anything else does (Daniel 4:35), how you need to hate and abhor wealth because it won't get you to "heaven"(Matthew 19:24), how you should cherish disease illness and pestilence because it's bringing you closer to heaven (Psalms 34:19), it's good to die from hunger pestillence or illness if that makes you obey the jewish 'god' (2 Corinthians 1:8-11), all Rich non-Jews have to be financially destroyed (Revelation 3:17), how you will suffer in eternal hell-fire for not following the "Master Rabbi" and so forth...

Rabbi Jesus (Matthew 1:1 - Hebrews 7:14, etc etc) did the greatest attainment for his racial comrades. It taught all the Goyim of the world slave values, and proto-communism.

This later created the Middle Ages of Serfdom where people became literal Goyim, the Communist regimes where the worker is robbed of all their work, the abolishing of ownership, the tyranny of debt and so forth. Rabbi Jesus has served the jews well. It's through the morality created by Rabbi Jesus that the Goyim go and give shekels over a holohoax that never even happened.

The Old Testament is by definition a jewish racial book, and the same goes for the New Testament, however, in the New Testament, the leaders like Jesus and the Apostles are Jewish. While the victims are Pagans and others. What does that tell us...It should be obvious. Of course the Quaran says similar things about wealth, such as for example that Islamics and Christians are disavowed by "God" to be "Money Lenders" and that only the Jews can do this.

So the jews amassed easily all the wealth of the planet just because some retards believed this was the great thing to do. We might as well call Christianity, the most giant spell for usurping the world's wealth to ever exist. It's all a financial spell basically, and as such it's said that Shekel is the God of the Jew, not "HaShem", which HP Don has mentioned before... Shek-El is actually the God of the Jews, EL is a short acronymic concept for their 'god'. JHVH is just a concept of the doer of magick, the racial God of the jews, and a representation of their aliens, knowledgeable ones, and those at the top. In short, the jewish occult mafia.

Some fools say the jews have a 'religion'. They don't have a religion. Their system is a parasitically spiritual founded system on scamming, killing, and robbing the Goyim. This is what their whole existence is about. This ensures they live a lazy and free life. They accomplished this by stolen spiritual means, and by sacrifice of generations, on top of the corpses of innumerable people that wasted whole lifetimes going after a loaf of bread, even if they lived in the most developed countries in the world. Even nowadays, hardly anything has changed.

What more needs to be stated? Do you still wonder why 90% of the world is below the reasonable level of living?

As for Christians who CAUSED all of this by their beliefs, work, christian pseudoculture, 'merciful attitude', serving the jews, believing in their god, accepting a jew as their 'savior', giving their psychic energy to the jewish programs, and accepting a reality of being robbed by the jews as 'given and good' that's all I have to say:

"Even as fools walk along the road, they lack sense and show everyone how stupid they are." -Ecclesiastes 10:3

-High Priest Hooded Cobra 666

A part of this, sometimes, it's real and valid of a concern. But the majority of these things always tend to be bogus. Astrologically speaking, Uranus is now in Taurus, which shows a modernization, and also change and possible reformation of the current financial status of this world. This can be for the better, or for the worse, but this influence will be upon this world for around 8 years.

The Entry of Uranus here happens around 2020, which is why many people are expecting some sort of change, which of course, most astrologers and most people are looking with suspicion or the usual paralyzing fear. When Uranus was entering Aries, people were also afraid of WW3, which indeed, was sometimes a possibility, but guess what, it didn't really happen. The answer here is that one cannot know for certain as the lives and existence of many is on the line and there is can be no answer directly here. As far as the spiritual aspect goes here our work is in line helping the situation of the world out and as always there is a juking out of where this so called 'system' is going. Uranus rules over unpredictability, but in general, Uranus also can help with revitalization and changing things for the better, not necessarily for the worst.

Predicting some bad event MAY happen in 8 years, is as if predicting it's going to rain once is Zimbabwe within the next 8 months. If it happens, then you are a prophet! If not, it's all fine - just prophesize against next tommorow, and for the next thousands of days until it rains. And when it does actually happen, make it real loud and proclaim "My holy predictions were right!".

If you constantly buy on this hype, and you do not look at life and choices with defiance, you will be permanently a slave. The people who engage in this foolish mentality are clearly lacking spiritual insight and are spiritually blind.

Out of all these millions of so called 'predictions', only one is correct. And the only ones who really will know are those who are experienced in risk taking, or really deeply into finances, or otherwise, have other actual premonitions of these things, and not yet another alarm for these every year. Every single month there is a report on the economy that is about to crash RIGHT NOW!

A specific type of born slaves people are fetishistic around these events. They just wish their life will be ended by some sort of comet, or that the economy will drop and kill them. They have wet dreams on visions of people running and crawling in the government to give them a loaf of bread, and they fantasize that these situations are good for revolutions or social change. The reality is however, when humanity sinks on the level of seeking a molded loaf of bread, the majority is done, civilization starts sinking. Depending on the type of civilization, the sinking can be rapid and deadly.

The doomsday prophets fetishize even harder. Maybe finally the Lord will come to save them? Are we the Chosen on the Final Days? Have we Repented enough?

It's as if they want the economy destroyed so they can prove their shitty dreams or "predictions" correct. "I predicted this 100 different times and failed, but this time I was correct, obey the prophet of the lord! For he knew how to predict a collapse, but he didn't know shit on how to avert it or WTF to do during it".

Others do get paid to write lies in regards to said collapses, wars that won't happen, endless bogus crap, and constantly re-affirm on the goyim how futile, pointless, and impossible is any form existential ascent. Do not have children goyim, for your societies will go down anyway. Do not have a relationship goyim, for love dies. Do not breathe air goyim, for you will die anyway. Finding and competing for a job that is good for you and trying to build a future for yourself? Why bother? This system will enslave you!

It is of thine enemy the Pharisee, saith Rabbi Yeshua. It is rigged! The old laws of willpower, spirituality, and mastery, have all but perished! Woe to us, goyim.

They act like Jesus on the mount whining about his racial cousins (and covering for) the "Pharisees", their financial power and wealth.

This very same whiny behavior is also what is creating jews wealth and power since forever. For the rich jew, you need poor goyim to exist.

The reality is that on said events, there can be no real or actual prediction, except if one is very deep in the know.

Nobody really knows 'when' and 'if' an economy is going to crash. The economy can be kept going, and there are no factors to actually 'crash' it that are the given. We are not in 1929, and most people's brains are still stuck in 1929. The economy is so artificial and so globalized it doesn't just drop by coincidence anymore, and can be kept going. The thing that is consistent is bubbles, and what do we mean by bubbles? False and unfounded investments and money going to disappear into a black hole.

Other than that, we are not a Forex group, nor an investment firm to give you financial advice. Maybe the doomsayers can give you some advice such as in the bible: "Sell all your possessions, and follow the lord! For it's easier than a hobo to reach heaven than the camel to go through the eye of the needle! Sell your homeless cart today, for it's the possession of a Gentile Sinner, and donate all 10 bucks from it to Jesus's Church so he can save you from the Pharisees and his racial cousins!".

If you want a personal statement, fuck what all these people who shit their pants say, and do what you have to do, as life involves risks. In the event that the economy dropped, your funds invested or not, wouldn't be in equally a good situation. You just have to be real careful in what you are investing, and making sure that any investment is realistic, and founded. Investments can fail, but this is like anything else, if you do not try, you will fail one hundred percent. If you do, you may actually succeed.

For example, the investment of a power generator costing 300$ today, would be a far better investment than an investment done in a murky time or environment. Indeed, this power generator turns into a savior under different circumstances, better than Christ who can't heal the flu.

People who are generally losers or do not have skills to do particular things, make sure to raise giant walls for other people. A person sucks in love, they preach the failure and futility of love. The miserable are also the greatest all knowing you will ever meet. They KNOW everything, but with all this knowledge, they are still worthless. Pity to the stupid ones, like us, who do not have their mighty knowledge! For if we had their knowledge we would also be...worthless.

Jews constantly lie of crashing economy so that no goyim invests or does anything in that regard. Prior to that they constantly said that when every goyim makes a fap, the world is going to end. "All is vanity, remain in shit forever, and wait the Lord Savior!". "The End is Coming!". "Its already here!".

What does happen on so called 'economic collapses' also? Jews and others in the know, do profit. As others fall, so do others rise, and this is the nature of this system.

If economics are vanity, then why do the jews invest hardcore, build hardcore wealth, while the goyim are waiting for "Holy Collapse" and shitting in their own pumpers and pretending the holiness of broke "Christos", the wretched hero, on whose name was built the greatest and richest criminal mafia which would make all mafias of the history of the world pale and look like innocent children.

"Wars and Rumors of Wars", "Kikes spreading the rumors of kikes", is the statement here.

What you have to do is your personal responsibility, and so is any other choice in life.

Below I am re-posting a sermon I have done on the subject:

____

Wealth: Jews Vs Gentiles

Mon Jul 10, 2017 10:00 pm High Priest Hoodedcobra666

I wanted to write something about this, to share some Truths known to all jews and the enemy, but these are vaguely known to any of others who are Cattle and "Goyim" by definition.

One thing we observe when we read this 2000 page book that is called the Bible (depending on the printing, normally has around 1500), we see some things that we can understand deeply. Excellent book to double speak, lie, and always find something to justify just about everything from. "The Word of God". This "God" is a real weasel, but guess why? Because it's nothing but a jewish racial projection and nothing else. OF course, most teachings are NOT contained in the bible at all, which brings us into innumerable pages.

The Old Testament, is what the Jews favor and is their crown jewel. This is their "Torah", however in a greater Torah, they also have other books. The Torah is a body of teachings, not just the Old Testament, but the Old Testament is the core of the magickal book. To be swift and not brush of the point to readers, I'll get to the point.

This book named the Old Testament, is chock filled with:

Blessings of wealth without doing anything, also known as parasitism (Proverbs 10:22), prosperity, Scamming other nations after causing massive war for financial gain(Zechariah 14:14), even if people give financial benefits to the jews they are to be killed anyway (Exodus 11:5), advice how to give and take money, always telling jews to take care financially of other jews such as not charging any interest (Deuteronomy 23:19), financial advice (Psalm 112:5), financial relationships advice between members of the jewish tribe (Leviticus 25:35-37), showing how to scam the Non Jews (Deuteronomy 23:19-20), how wealth belongs to the jewish 'god; and subsequently to the Jewish race (Haggai 2:8), how the jewish god gives wealth (Deuteronomy 8:18), advice on how to grow wealth (Proverbs 13:11), 'promises by god' to 'lend to nations' as a blessing (Deuteronomy 15:6), how you should take false oaths as a jew and never pay back debts (to Goyim - Ecclesiastes 5:5), the Jew is supposed to kill even those who housed them simply because those who housed them may be richer than the jews or make them work (Isaiah 19)...

This is a magickal spell book that has countless spells about prosperity for the jews, damning the prosperity of the Gentiles, creating impoverishment and profiting from it, taking the highest social position in Gentile lands (The whole story of Joseph in Genesis, the Jew who betrayed Egypt, includes all the above), how to marry to infiltrate and take over races and when not to (1 Kings 2:21), how the jews should always remain racially loyal and pure of blood and kill race traitors(1 Kings 2:24), and it even has all sorts of

other things such as laws on how to lend money to Gentiles and to jews (Exodus 22:25), how your race-kin family and race are the most important thing in the world (Jeremiah 33:17-18), how you should NEVER believe in the Gods of the Gentiles (Exodus 20:3), how there is a STRICT social order that the jews need to follow in order to succeed, how they must always remember that their relation to their 'god' is racial (Leviticus 26:42). These are to name a few.

On the same book, that Christians worship, put their hands upon and take oaths, gloat and glorify, we have what is called the New Testament. This was written many thousands of years later for the guillible Goyim.

Jesus was a replacement, mimic jewish infiltrator deity, to hijack and replace the Pagan Gods. And preach the exact reverse in order to kill us all.

Now however, this part of the "Scripture" is for the Goyim, the Gentiles, the animals of the field. So what this book writes is simple.

How supposedly "Wealth" is so AGAINST "Spirituality" (Matthew 6:24), how if you supposedly serve money you can't serve God (so leave this to the jews Goyim - Luke 16:13-15), How you should lend your ENEMIES -like the jews- (Luke 6:35), Curses for the Rich Gentiles (James 5:1-6), How there is no race and how we are all equals to 'god', how you should always share what you have even when you don't have anything, how you should gloat over and eternally worship the jewish "God" while FROWNING and CURSING your own Gods and not worshiping them either (1 Corinthians 10:20-21), how you should give your money for the jews in churches even if you don't have to survive (Mark 12:41-44), how you should be against all wealth posessions because it's greed (Luke 12:15), how one should hate wealth since it's a "Jewish Thing" practiced by the Jewish Pharisees and never the Goyim should practice anything similar (Matthew 21:12), how the "Love of Money is the Root of all Evil" (1 Timothy 6:10), wealth is destructive (1 Timothy 6:9), how you need to sell your possessions to follow a fictitious rabbi that never existed (Matthew 19:21), how you need to give up thoughts of survival and managing or amassing any amount of wealth whatsover (Matthew 6:19–20), how you need to leave and desert your family (Luke 14:26), how you need to get USED TO BEING SCAMMED and BE ROBBED (Luke 6:30), how you should give not a fuck about any social order and only trust Jesus Christ as "Authority" (Galatians 3:28), the earth nor the planet matters one dime neither anything else does (Daniel 4:35), how you need to hate and abhor wealth because it won't get you to "heaven"(Matthew 19:24), how you should cherish disease illness and pestilence because it's bringing you closer to heaven (Psalms 34:19), it's good to die from hunger pestillence or illness if that makes you obey the jewish 'god' (2 Corinthians 1:8-11), all Rich non-Jews have to be financially destroyed (Revelation 3:17), how you will suffer in eternal hell-fire for not following the "Master Rabbi" and so forth...

Rabbi Jesus (Matthew 1:1 - Hebrews 7:14, etc etc) did the greatest attainment for his racial comrades. It taught all the Goyim of the world slave values, and proto-communism.

This later created the Middle Ages of Serfdom where people became literal Goyim, the Communist regimes where the worker is robbed of all their work, the abolishing of ownership, the tyranny of debt and so forth. Rabbi Jesus has served the jews well. It's through the morality created by Rabbi Jesus that the Goyim go and give shekels over a holohoax that never even happened.

The Old Testament is by definition a jewish racial book, and the same goes for the New Testament, however, in the New Testament, the leaders like Jesus and the Apostles are Jewish. While the victims are Pagans and others. What does that tell us...It should be obvious. Of course the Quaran says similar things about wealth, such as for example that Islamics and Christians are disavowed by "God" to be "Money Lenders" and that only the Jews can do this.

So the jews amassed easily all the wealth of the planet just because some retards believed this was the great thing to do. We might as well call Christianity, the most giant spell for usurping the world's wealth to ever exist. It's all a financial spell basically, and as such it's said that Shekel is the God of the Jew, not "HaShem", which HP Don has mentioned before... Shek-El is actually the God of the Jews, EL is a short acronymic concept for their 'god'. JHVH is just a concept of the doer of magick, the racial God of the jews, and a representation of their aliens, knowledgeable ones, and those at the top. In short, the jewish occult mafia.

Some fools say the jews have a 'religion'. They don't have a religion. Their system is a parasitically spiritual founded system on scamming, killing, and robbing the Goyim. This is what their whole existence is about. This ensures they live a lazy and free life. They accomplished this by stolen spiritual means, and by sacrifice of generations, on top of the corpses of innumerable people that wasted whole lifetimes going after a loaf of bread, even if they lived in the most developed countries in the world. Even nowadays, hardly anything has changed.

What more needs to be stated? Do you still wonder why 90% of the world is below the reasonable level of living?

As for Christians who CAUSED all of this by their beliefs, work, christian pseudoculture, 'merciful attitude', serving the jews, believing in their god, accepting a jew as their 'savior', giving their psychic energy to the jewish programs, and accepting a reality of being robbed by the jews as 'given and good' that's all I have to say:

"Even as fools walk along the road, they lack sense and show everyone how stupid they are." -Ecclesiastes 10:3

-High Priest Hooded Cobra 666

StraitShot47

Member

- Joined

- Sep 20, 2017

- Messages

- 745

You don't have to answer this, but if it's a large investment. See if you can get a house instead.

If we're just talking about a couple grand, then yes invest it.

At the end of the day it was never truly your money, so if it's lost oh well. You lost nothing.

If we're just talking about a couple grand, then yes invest it.

At the end of the day it was never truly your money, so if it's lost oh well. You lost nothing.

You do not need to write any details on this.

Just see if you can put your money in non useless things that are somehow of use and long term use to you.

Most people who invest or have a proper livelihood also put their money in things that can be used of use with or without money. Ie houses, infrastructure, creation of your own vegetable field, buying livestock if you live outside the city, the list goes.

Just see if you can put your money in non useless things that are somehow of use and long term use to you.

Most people who invest or have a proper livelihood also put their money in things that can be used of use with or without money. Ie houses, infrastructure, creation of your own vegetable field, buying livestock if you live outside the city, the list goes.

Savitar

New member

- Joined

- Sep 23, 2017

- Messages

- 234

My suggestion for your parents is to invest time first into learning about different assets (be it real estate, stocks, options or futures, cryptos etc) If they do, it is possible to make money wether the market is going up or down.

Also a defined goal is needed. What is the purpose of their investing?

Is their goal to increase their net worth (Capital Gains)

Or to increase their monthly income? (Cash Flow)

Or maybe they want to secure their savings and protect it from devaluation (Hedge)

Each asset has their own advantage.

To give an example:

The advantage of stocks and other paper assets is liquidity: You can buy or sell them in a matter of hours or even mintues (seconds on the Forex Market) you can start with low capital. And can practice without risk (Paper Account)

The disadvantage is the lack of control: The company makes a huge mistake and the stock prices are dropping - you have no control of the investment unless you’re one of the major share holders. The only thing you can do is to prepare, secure the investment with options and sell the stock if you need to. Thats it.

The advantage of Real Estate is that the control is in your hands. You make the decisions, you make the contracts etc. Plus you can get cash flow out of it regardless of market conditions. Smart renovations (Solar Panels for example) can keep the value high even during a Bear Market.

The disadvantage: higher amount of capital needed, loans, etc. If you buy a house, and want out of the deal, you may have to wait for months until you’re able to sell it. There is no free and risk free way of trying yourself out.

Each and every asset can benefit you if you know them enough and use it in a planned systematic, strategic manner. There are different techniques to investing (day trading, swing trading, price action trading, vertical spreads, calendar spreads, selling covered calls, carry trading building a dividend portfolio, fix and flip, renting out, lease options) Each method has their benefits as well, but not all of them are appropriate for everyone and for all goals.

Start with creating a financial plan for security (What is the monthly financial need in the present what will it be in the future?, how to secure the sources of income needed for this minimal amount of income?)

After that create a financial plan for a higher standard of living (how to increase income to finance a healthier, more comfortable and altogether better lifestyle)

The third plan is a plan is to generate vast amounts of wealth and become rich. (This requires time, effort, learning, and also a team: help from financial and legal advisors advisors.)

As a final note the main risk in investing lies in the lack of knowledge, lack of information and the lack of control.

1.Control over the legal form (form of business), the type of income (portfolio or passive) and timing (when to buy or sell)

2.Control over contracts (terms and conditions)

3. control over the ratio of income/expenses, ratio of assets and liabilities.

4. Control of taxes

5. Control of information

6. Control over the investment (be it a small house, a portfolio, or a business)

7. most importantly :control over yourself (managing the emotions of fear and greed)

Having all of the above means that risk is virtually eliminated regardless of market comditions. Lacking them means risk is potentially unlimited - regardless of market conditions.

Also a defined goal is needed. What is the purpose of their investing?

Is their goal to increase their net worth (Capital Gains)

Or to increase their monthly income? (Cash Flow)

Or maybe they want to secure their savings and protect it from devaluation (Hedge)

Each asset has their own advantage.

To give an example:

The advantage of stocks and other paper assets is liquidity: You can buy or sell them in a matter of hours or even mintues (seconds on the Forex Market) you can start with low capital. And can practice without risk (Paper Account)

The disadvantage is the lack of control: The company makes a huge mistake and the stock prices are dropping - you have no control of the investment unless you’re one of the major share holders. The only thing you can do is to prepare, secure the investment with options and sell the stock if you need to. Thats it.

The advantage of Real Estate is that the control is in your hands. You make the decisions, you make the contracts etc. Plus you can get cash flow out of it regardless of market conditions. Smart renovations (Solar Panels for example) can keep the value high even during a Bear Market.

The disadvantage: higher amount of capital needed, loans, etc. If you buy a house, and want out of the deal, you may have to wait for months until you’re able to sell it. There is no free and risk free way of trying yourself out.

Each and every asset can benefit you if you know them enough and use it in a planned systematic, strategic manner. There are different techniques to investing (day trading, swing trading, price action trading, vertical spreads, calendar spreads, selling covered calls, carry trading building a dividend portfolio, fix and flip, renting out, lease options) Each method has their benefits as well, but not all of them are appropriate for everyone and for all goals.

Start with creating a financial plan for security (What is the monthly financial need in the present what will it be in the future?, how to secure the sources of income needed for this minimal amount of income?)

After that create a financial plan for a higher standard of living (how to increase income to finance a healthier, more comfortable and altogether better lifestyle)

The third plan is a plan is to generate vast amounts of wealth and become rich. (This requires time, effort, learning, and also a team: help from financial and legal advisors advisors.)

As a final note the main risk in investing lies in the lack of knowledge, lack of information and the lack of control.

1.Control over the legal form (form of business), the type of income (portfolio or passive) and timing (when to buy or sell)

2.Control over contracts (terms and conditions)

3. control over the ratio of income/expenses, ratio of assets and liabilities.

4. Control of taxes

5. Control of information

6. Control over the investment (be it a small house, a portfolio, or a business)

7. most importantly :control over yourself (managing the emotions of fear and greed)

Having all of the above means that risk is virtually eliminated regardless of market comditions. Lacking them means risk is potentially unlimited - regardless of market conditions.

Savitar, your signature, I may borrow for a future sermon.

Plus, excellent reply.

Plus, excellent reply.

Aquarius

Well-known member

- Joined

- Sep 20, 2017

- Messages

- 9,641

Thank you a lot brother, your answers as always are fantastic lolSavitar said:My suggestion for your parents is to invest time first into learning about different assets (be it real estate, stocks, options or futures, cryptos etc) If they do, it is possible to make money wether the market is going up or down.

Also a defined goal is needed. What is the purpose of their investing?

Is their goal to increase their net worth (Capital Gains)

Or to increase their monthly income? (Cash Flow)

Or maybe they want to secure their savings and protect it from devaluation (Hedge)

Each asset has their own advantage.

To give an example:

The advantage of stocks and other paper assets is liquidity: You can buy or sell them in a matter of hours or even mintues (seconds on the Forex Market) you can start with low capital. And can practice without risk (Paper Account)

The disadvantage is the lack of control: The company makes a huge mistake and the stock prices are dropping - you have no control of the investment unless you’re one of the major share holders. The only thing you can do is to prepare, secure the investment with options and sell the stock if you need to. Thats it.

The advantage of Real Estate is that the control is in your hands. You make the decisions, you make the contracts etc. Plus you can get cash flow out of it regardless of market conditions. Smart renovations (Solar Panels for example) can keep the value high even during a Bear Market.

The disadvantage: higher amount of capital needed, loans, etc. If you buy a house, and want out of the deal, you may have to wait for months until you’re able to sell it. There is no free and risk free way of trying yourself out.

Each and every asset can benefit you if you know them enough and use it in a planned systematic, strategic manner. There are different techniques to investing (day trading, swing trading, price action trading, vertical spreads, calendar spreads, selling covered calls, carry trading building a dividend portfolio, fix and flip, renting out, lease options) Each method has their benefits as well, but not all of them are appropriate for everyone and for all goals.

Start with creating a financial plan for security (What is the monthly financial need in the present what will it be in the future?, how to secure the sources of income needed for this minimal amount of income?)

After that create a financial plan for a higher standard of living (how to increase income to finance a healthier, more comfortable and altogether better lifestyle)

The third plan is a plan is to generate vast amounts of wealth and become rich. (This requires time, effort, learning, and also a team: help from financial and legal advisors advisors.)

As a final note the main risk in investing lies in the lack of knowledge, lack of information and the lack of control.

1.Control over the legal form (form of business), the type of income (portfolio or passive) and timing (when to buy or sell)

2.Control over contracts (terms and conditions)

3. control over the ratio of income/expenses, ratio of assets and liabilities.

4. Control of taxes

5. Control of information

6. Control over the investment (be it a small house, a portfolio, or a business)

7. most importantly :control over yourself (managing the emotions of fear and greed)

Having all of the above means that risk is virtually eliminated regardless of market comditions. Lacking them means risk is potentially unlimited - regardless of market conditions.

and thank you HP for declining the last post of mine I was too careless about posting my info :/

Savitar

New member

- Joined

- Sep 23, 2017

- Messages

- 234

HP Hoodedcobra by all means! The life and work of Emperor Julian is prescious and this quote really sums up the relationship between us and the Gods.

Thank you for the compliment, I’m looking forward to become active again and share what I can

@Aquarius you welcome bro Always happy to help with :idea: s.

Always happy to help with :idea: s.

Thank you for the compliment, I’m looking forward to become active again and share what I can

@Aquarius you welcome bro

Savitar said:My suggestion for your parents is to invest time first into learning about different assets (be it real estate, stocks, options or futures, cryptos etc) If they do, it is possible to make money wether the market is going up or down.

Also a defined goal is needed. What is the purpose of their investing?

Is their goal to increase their net worth (Capital Gains)

Or to increase their monthly income? (Cash Flow)

Or maybe they want to secure their savings and protect it from devaluation (Hedge)

Each asset has their own advantage.

To give an example:

The advantage of stocks and other paper assets is liquidity: You can buy or sell them in a matter of hours or even mintues (seconds on the Forex Market) you can start with low capital. And can practice without risk (Paper Account)

The disadvantage is the lack of control: The company makes a huge mistake and the stock prices are dropping - you have no control of the investment unless you’re one of the major share holders. The only thing you can do is to prepare, secure the investment with options and sell the stock if you need to. Thats it.

The advantage of Real Estate is that the control is in your hands. You make the decisions, you make the contracts etc. Plus you can get cash flow out of it regardless of market conditions. Smart renovations (Solar Panels for example) can keep the value high even during a Bear Market.

The disadvantage: higher amount of capital needed, loans, etc. If you buy a house, and want out of the deal, you may have to wait for months until you’re able to sell it. There is no free and risk free way of trying yourself out.

Each and every asset can benefit you if you know them enough and use it in a planned systematic, strategic manner. There are different techniques to investing (day trading, swing trading, price action trading, vertical spreads, calendar spreads, selling covered calls, carry trading building a dividend portfolio, fix and flip, renting out, lease options) Each method has their benefits as well, but not all of them are appropriate for everyone and for all goals.

Start with creating a financial plan for security (What is the monthly financial need in the present what will it be in the future?, how to secure the sources of income needed for this minimal amount of income?)

After that create a financial plan for a higher standard of living (how to increase income to finance a healthier, more comfortable and altogether better lifestyle)

The third plan is a plan is to generate vast amounts of wealth and become rich. (This requires time, effort, learning, and also a team: help from financial and legal advisors advisors.)

As a final note the main risk in investing lies in the lack of knowledge, lack of information and the lack of control.

1.Control over the legal form (form of business), the type of income (portfolio or passive) and timing (when to buy or sell)

2.Control over contracts (terms and conditions)

3. control over the ratio of income/expenses, ratio of assets and liabilities.

4. Control of taxes

5. Control of information

6. Control over the investment (be it a small house, a portfolio, or a business)

7. most importantly :control over yourself (managing the emotions of fear and greed)

Having all of the above means that risk is virtually eliminated regardless of market comditions. Lacking them means risk is potentially unlimited - regardless of market conditions.

I first read Hoodedcobra's post and then yours as I have a very small amount of saving in dollars (but it's worth a considerable amount in our national currency due to exchange rates) and I have to make use of it as well as possible to maximise its value in the next two years because it is certain due to various reasons that I won't be able to save during that time. Hoodedcobra mentioned that we are in a 8 year period where some sort of financial structural change is more possible than before and you added advice on traditional financial tools of investment. As it's often customary in our country, my initial idea was to buy a cottage in Spain (example) because there are really affordable properties there where I can live with my pets without asking for anybody's permission and even cultivate small amounts of products in the garden to sustain myself. Also, I always thought of it as an emergency flight escape since our country is under a wretched government's regime where everything's organised according to Islam as opposed to the times when I was a kid.

But considering your advice and that of Hoodedcobra, I started to think that investing in blockchain and cryptocurrencies could be a much more lucrative manoeuvre if done wisely and properly. On the other hand, the popular cryptocurrencies and fintech enterprises based on blockchain are on a steady decline for a year and it might be a big gamble. May I have your opinions? Which way would you go? I feel like both of my options are motivated by fears and I know that's not a healthy way to make decisions.

Aquarius

Well-known member

- Joined

- Sep 20, 2017

- Messages

- 9,641

I’d avoid cryptos.....… it was good if u invested 8 years ago, now you would be rich, but now notAdondis said:Savitar said:My suggestion for your parents is to invest time first into learning about different assets (be it real estate, stocks, options or futures, cryptos etc) If they do, it is possible to make money wether the market is going up or down.

Also a defined goal is needed. What is the purpose of their investing?

Is their goal to increase their net worth (Capital Gains)

Or to increase their monthly income? (Cash Flow)

Or maybe they want to secure their savings and protect it from devaluation (Hedge)

Each asset has their own advantage.

To give an example:

The advantage of stocks and other paper assets is liquidity: You can buy or sell them in a matter of hours or even mintues (seconds on the Forex Market) you can start with low capital. And can practice without risk (Paper Account)

The disadvantage is the lack of control: The company makes a huge mistake and the stock prices are dropping - you have no control of the investment unless you’re one of the major share holders. The only thing you can do is to prepare, secure the investment with options and sell the stock if you need to. Thats it.

The advantage of Real Estate is that the control is in your hands. You make the decisions, you make the contracts etc. Plus you can get cash flow out of it regardless of market conditions. Smart renovations (Solar Panels for example) can keep the value high even during a Bear Market.

The disadvantage: higher amount of capital needed, loans, etc. If you buy a house, and want out of the deal, you may have to wait for months until you’re able to sell it. There is no free and risk free way of trying yourself out.

Each and every asset can benefit you if you know them enough and use it in a planned systematic, strategic manner. There are different techniques to investing (day trading, swing trading, price action trading, vertical spreads, calendar spreads, selling covered calls, carry trading building a dividend portfolio, fix and flip, renting out, lease options) Each method has their benefits as well, but not all of them are appropriate for everyone and for all goals.

Start with creating a financial plan for security (What is the monthly financial need in the present what will it be in the future?, how to secure the sources of income needed for this minimal amount of income?)

After that create a financial plan for a higher standard of living (how to increase income to finance a healthier, more comfortable and altogether better lifestyle)

The third plan is a plan is to generate vast amounts of wealth and become rich. (This requires time, effort, learning, and also a team: help from financial and legal advisors advisors.)

As a final note the main risk in investing lies in the lack of knowledge, lack of information and the lack of control.

1.Control over the legal form (form of business), the type of income (portfolio or passive) and timing (when to buy or sell)

2.Control over contracts (terms and conditions)

3. control over the ratio of income/expenses, ratio of assets and liabilities.

4. Control of taxes

5. Control of information

6. Control over the investment (be it a small house, a portfolio, or a business)

7. most importantly :control over yourself (managing the emotions of fear and greed)

Having all of the above means that risk is virtually eliminated regardless of market comditions. Lacking them means risk is potentially unlimited - regardless of market conditions.

I first read Hoodedcobra's post and then yours as I have a very small amount of saving in dollars (but it's worth a considerable amount in our national currency due to exchange rates) and I have to make use of it as well as possible to maximise its value in the next two years because it is certain due to various reasons that I won't be able to save during that time. Hoodedcobra mentioned that we are in a 8 year period where some sort of financial structural change is more possible than before and you added advice on traditional financial tools of investment. As it's often customary in our country, my initial idea was to buy a cottage in Spain (example) because there are really affordable properties there where I can live with my pets without asking for anybody's permission and even cultivate small amounts of products in the garden to sustain myself. Also, I always thought of it as an emergency flight escape since our country is under a wretched government's regime where everything's organised according to Islam as opposed to the times when I was a kid.

But considering your advice and that of Hoodedcobra, I started to think that investing in blockchain and cryptocurrencies could be a much more lucrative manoeuvre if done wisely and properly. On the other hand, the popular cryptocurrencies and fintech enterprises based on blockchain are on a steady decline for a year and it might be a big gamble. May I have your opinions? Which way would you go? I feel like both of my options are motivated by fears and I know that's not a healthy way to make decisions.

Savitar

New member

- Joined

- Sep 23, 2017

- Messages

- 234

Adondis said:I first read Hoodedcobra's post and then yours as I have a very small amount of saving in dollars (but it's worth a considerable amount in our national currency due to exchange rates) and I have to make use of it as well as possible to maximise its value in the next two years because it is certain due to various reasons that I won't be able to save during that time. Hoodedcobra mentioned that we are in a 8 year period where some sort of financial structural change is more possible than before and you added advice on traditional financial tools of investment. As it's often customary in our country, my initial idea was to buy a cottage in Spain (example) because there are really affordable properties there where I can live with my pets without asking for anybody's permission and even cultivate small amounts of products in the garden to sustain myself. Also, I always thought of it as an emergency flight escape since our country is under a wretched government's regime where everything's organised according to Islam as opposed to the times when I was a kid.

But considering your advice and that of Hoodedcobra, I started to think that investing in blockchain and cryptocurrencies could be a much more lucrative manoeuvre if done wisely and properly. On the other hand, the popular cryptocurrencies and fintech enterprises based on blockchain are on a steady decline for a year and it might be a big gamble. May I have your opinions? Which way would you go? I feel like both of my options are motivated by fears and I know that's not a healthy way to make decisions.

Financial security, exposure to any risk, or crisis is a legitimate concern, It is completely healthy, that you want to take action in this direction.

Jumping into any business, crypto or real estate due to fear/greed wth out preparation on the other hand is definetly no good.

If I understood correctly: You are looking for ways to increase your income levels, because in the future you won’t be able to save money, or your income levels will decrease. Am I correct?

If this is the case, your investing goal/purpose should be to increase cash-flow.

Regarding Crypto: I’m still in the studying phase, therefore I cannot give you any advice based on experience. However what I know is that the technology is here to stay, it has real, intrinsic value, incredible potential. The current bear market is close to an end. On the other hand, about 90-95% of ICO-s, alt-coins are scams.

-Cryptos are mainly for capital gains and hedge, but there are several strategies for cash flow:

-Hodl dividend paying Cryptos: the best of these pay around 5-10% per year

-Learn how to trade learn one, or a few trading strategies and trade Crypto CFDS-s. With CFD you can use leverage up to 5 and make money on downward movements as well. (Not to mention, that you can also absorb losses of a crypto portfolio you Hodl by setting sell pending orders below market price)

If you plan to stick with crypto: prepare to invest a lot of time and energy into educating yourself and practice trading on a paper account.

You will learn to set a system, a routine of trading, set a weekly goal and a certain percentage you withdraw from your account to use as income

By immersing yourself, the opportunity to invest into legit alt-coins with huge returns will be open, since with proper education you can smell scams from miles away.

Short summary:

1. Invest time, energy, and money into training, education and learning

2. Practice on paper account

3. Try out the real deal with a small portion of your savings, which you will handle as risk capital. Do not invest all of your savings!! The strength of your Fear/Greed changes with the invested money.

4. Once you gain experience, increase the amount you invest gradually.

5. Do not become a gambler: Pouring your funds imto something and doing some money/energy work won’t pay. Using money spells

6. and positive affirmations regarding your wealth and success combined with proper education, preparation and practice is what pays off.

Creating Cash-Flow from Real Estate is simpler, (Rent Out, or Lease Option) but the risk is that your money not liquid, a bad buying decision is hard to correct.

Do you live in Spain? If not, I advise not to start in a foreign country and education is also a must!

An advice:

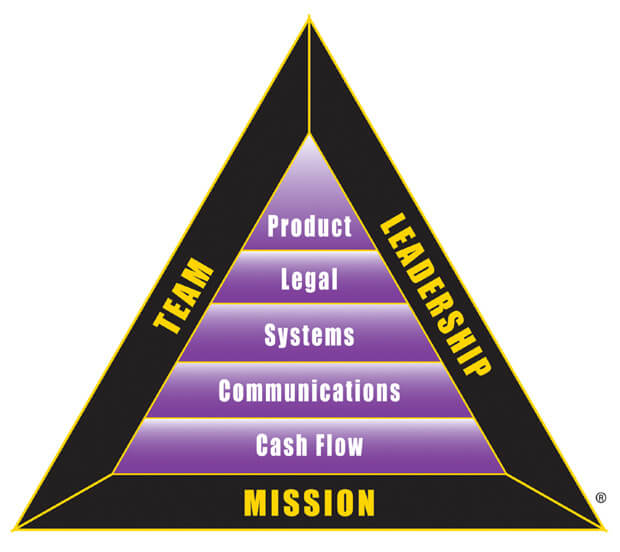

A good solution to increasing your income is to start/join a part time network marketing business that offers you additional training on the field of sales, communication, personality etc. It’s an exellent way to develop the skills for business, and all investing is a business, with the same fundamental structure:

Apply this to crypto trading:

-You are the leader, the mission is to create prosperity for yourself and your beloved ones. The Team is anyone who has something to do with Crypto Trading activity: advisors, creaters of softwares you use for trading, the brokers, the staff behind the trading platform etc.

For a succesful business, Cash-Flow is the foundation. In Crypto Trading, this means that the overall trading activie brings in money. The winning trades are the income and losing ones are the regular business expenses.

-You need efficient communication with your “team” to avoid problems or to solve them.

-You need a business system, a repeatable process, that can be automated. In crypto: setting up a software, that gives you trading signals based on your strategy. This way, you don’t have to glue yourself to the monitor. Setting uo a sofware that shows you graohs about your performance, that can help in make decisions etc.

-You need legal knowledge, how to tax after your gains, what legal protection your funds and account has, etc.

-Your product in this case is the trading activity itself.

Apply the same to real estate:

-Cash Flow: The income from the rental payments should cover all the related costs and create passive income. This is the foundation

-Communicate with the people who rent your house, with anyone who works on your house etc.

-Create a system, which allows the automation of the whole process or at least spares a ajor amount of time and energy for you

-Contracts, any laws regarding real estate business and proprety

-The product is your incredible house for use at available price and fair rental policy

As a final note:

Look for seminars/webinars where you can find mentors and and learn through immersion. Investing has It’s own language and a dialect for each asset. You can learn a foreign language from a book, teacher, or by visitng the country and and immersing yourself. You learn a lot more this way.

With proper knowledge (that allows you to invest successfully) you would already know exactly what action to take. Therefore there is no point in putting money in any asset. You should first invest money into financial education, your own mind. This is the signle and best investment, that will make you rich. In the end, It’s not Real Estate, Crypto (insert any other asset) that creates wealth, It’s your knowledge about these assets, that creates wealth. Your own mind and knowledge is the real money maker.

Aquarius

Well-known member

- Joined

- Sep 20, 2017

- Messages

- 9,641

Savitar you the best, I am wondering, are you making a living with investing and stock market and that stuff?Savitar said:Adondis said:I first read Hoodedcobra's post and then yours as I have a very small amount of saving in dollars (but it's worth a considerable amount in our national currency due to exchange rates) and I have to make use of it as well as possible to maximise its value in the next two years because it is certain due to various reasons that I won't be able to save during that time. Hoodedcobra mentioned that we are in a 8 year period where some sort of financial structural change is more possible than before and you added advice on traditional financial tools of investment. As it's often customary in our country, my initial idea was to buy a cottage in Spain (example) because there are really affordable properties there where I can live with my pets without asking for anybody's permission and even cultivate small amounts of products in the garden to sustain myself. Also, I always thought of it as an emergency flight escape since our country is under a wretched government's regime where everything's organised according to Islam as opposed to the times when I was a kid.

But considering your advice and that of Hoodedcobra, I started to think that investing in blockchain and cryptocurrencies could be a much more lucrative manoeuvre if done wisely and properly. On the other hand, the popular cryptocurrencies and fintech enterprises based on blockchain are on a steady decline for a year and it might be a big gamble. May I have your opinions? Which way would you go? I feel like both of my options are motivated by fears and I know that's not a healthy way to make decisions.

Financial security, exposure to any risk, or crisis is a legitimate concern, It is completely healthy, that you want to take action in this direction.

Jumping into any business, crypto or real estate due to fear/greed wth out preparation on the other hand is definetly no good.

If I understood correctly: You are looking for ways to increase your income levels, because in the future you won’t be able to save money, or your income levels will decrease. Am I correct?

If this is the case, your investing goal/purpose should be to increase cash-flow.

Regarding Crypto: I’m still in the studying phase, therefore I cannot give you any advice based on experience. However what I know is that the technology is here to stay, it has real, intrinsic value, incredible potential. The current bear market is close to an end. On the other hand, about 90-95% of ICO-s, alt-coins are scams.

-Cryptos are mainly for capital gains and hedge, but there are several strategies for cash flow:

-Hodl dividend paying Cryptos: the best of these pay around 5-10% per year

-Learn how to trade learn one, or a few trading strategies and trade Crypto CFDS-s. With CFD you can use leverage up to 5 and make money on downward movements as well. (Not to mention, that you can also absorb losses of a crypto portfolio you Hodl by setting sell pending orders below market price)

If you plan to stick with crypto: prepare to invest a lot of time and energy into educating yourself and practice trading on a paper account.

You will learn to set a system, a routine of trading, set a weekly goal and a certain percentage you withdraw from your account to use as income

By immersing yourself, the opportunity to invest into legit alt-coins with huge returns will be open, since with proper education you can smell scams from miles away.

Short summary:

1. Invest time, energy, and money into training, education and learning

2. Practice on paper account

3. Try out the real deal with a small portion of your savings, which you will handle as risk capital. Do not invest all of your savings!! The strength of your Fear/Greed changes with the invested money.

4. Once you gain experience, increase the amount you invest gradually.

5. Do not become a gambler: Pouring your funds imto something and doing some money/energy work won’t pay. Using money spells

6. and positive affirmations regarding your wealth and success combined with proper education, preparation and practice is what pays off.

Creating Cash-Flow from Real Estate is simpler, (Rent Out, or Lease Option) but the risk is that your money not liquid, a bad buying decision is hard to correct.

Do you live in Spain? If not, I advise not to start in a foreign country and education is also a must!

An advice:

A good solution to increasing your income is to start/join a part time network marketing business that offers you additional training on the field of sales, communication, personality etc. It’s an exellent way to develop the skills for business, and all investing is a business, with the same fundamental structure:

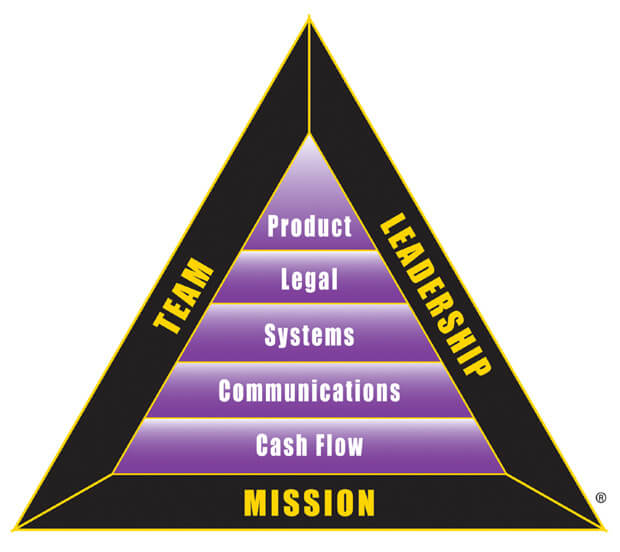

Apply this to crypto trading:

-You are the leader, the mission is to create prosperity for yourself and your beloved ones. The Team is anyone who has something to do with Crypto Trading activity: advisors, creaters of softwares you use for trading, the brokers, the staff behind the trading platform etc.

For a succesful business, Cash-Flow is the foundation. In Crypto Trading, this means that the overall trading activie brings in money. The winning trades are the income and losing ones are the regular business expenses.

-You need efficient communication with your “team” to avoid problems or to solve them.

-You need a business system, a repeatable process, that can be automated. In crypto: setting up a software, that gives you trading signals based on your strategy. This way, you don’t have to glue yourself to the monitor. Setting uo a sofware that shows you graohs about your performance, that can help in make decisions etc.

-You need legal knowledge, how to tax after your gains, what legal protection your funds and account has, etc.

-Your product in this case is the trading activity itself.

Apply the same to real estate:

-Cash Flow: The income from the rental payments should cover all the related costs and create passive income. This is the foundation

-Communicate with the people who rent your house, with anyone who works on your house etc.

-Create a system, which allows the automation of the whole process or at least spares a ajor amount of time and energy for you

-Contracts, any laws regarding real estate business and proprety

-The product is your incredible house for use at available price and fair rental policy

As a final note:

Look for seminars/webinars where you can find mentors and and learn through immersion. Investing has It’s own language and a dialect for each asset. You can learn a foreign language from a book, teacher, or by visitng the country and and immersing yourself. You learn a lot more this way.

With proper knowledge (that allows you to invest successfully) you would already know exactly what action to take. Therefore there is no point in putting money in any asset. You should first invest money into financial education, your own mind. This is the signle and best investment, that will make you rich. In the end, It’s not Real Estate, Crypto (insert any other asset) that creates wealth, It’s your knowledge about these assets, that creates wealth. Your own mind and knowledge is the real money maker.

Savitar said:Adondis said:I first read Hoodedcobra's post and then yours as I have a very small amount of saving in dollars (but it's worth a considerable amount in our national currency due to exchange rates) and I have to make use of it as well as possible to maximise its value in the next two years because it is certain due to various reasons that I won't be able to save during that time. Hoodedcobra mentioned that we are in a 8 year period where some sort of financial structural change is more possible than before and you added advice on traditional financial tools of investment. As it's often customary in our country, my initial idea was to buy a cottage in Spain (example) because there are really affordable properties there where I can live with my pets without asking for anybody's permission and even cultivate small amounts of products in the garden to sustain myself. Also, I always thought of it as an emergency flight escape since our country is under a wretched government's regime where everything's organised according to Islam as opposed to the times when I was a kid.

But considering your advice and that of Hoodedcobra, I started to think that investing in blockchain and cryptocurrencies could be a much more lucrative manoeuvre if done wisely and properly. On the other hand, the popular cryptocurrencies and fintech enterprises based on blockchain are on a steady decline for a year and it might be a big gamble. May I have your opinions? Which way would you go? I feel like both of my options are motivated by fears and I know that's not a healthy way to make decisions.

Financial security, exposure to any risk, or crisis is a legitimate concern, It is completely healthy, that you want to take action in this direction.

Jumping into any business, crypto or real estate due to fear/greed wth out preparation on the other hand is definetly no good.

If I understood correctly: You are looking for ways to increase your income levels, because in the future you won’t be able to save money, or your income levels will decrease. Am I correct?

If this is the case, your investing goal/purpose should be to increase cash-flow.

Regarding Crypto: I’m still in the studying phase, therefore I cannot give you any advice based on experience. However what I know is that the technology is here to stay, it has real, intrinsic value, incredible potential. The current bear market is close to an end. On the other hand, about 90-95% of ICO-s, alt-coins are scams.

-Cryptos are mainly for capital gains and hedge, but there are several strategies for cash flow:

-Hodl dividend paying Cryptos: the best of these pay around 5-10% per year

-Learn how to trade learn one, or a few trading strategies and trade Crypto CFDS-s. With CFD you can use leverage up to 5 and make money on downward movements as well. (Not to mention, that you can also absorb losses of a crypto portfolio you Hodl by setting sell pending orders below market price)

If you plan to stick with crypto: prepare to invest a lot of time and energy into educating yourself and practice trading on a paper account.

You will learn to set a system, a routine of trading, set a weekly goal and a certain percentage you withdraw from your account to use as income

By immersing yourself, the opportunity to invest into legit alt-coins with huge returns will be open, since with proper education you can smell scams from miles away.

Short summary:

1. Invest time, energy, and money into training, education and learning

2. Practice on paper account

3. Try out the real deal with a small portion of your savings, which you will handle as risk capital. Do not invest all of your savings!! The strength of your Fear/Greed changes with the invested money.

4. Once you gain experience, increase the amount you invest gradually.

5. Do not become a gambler: Pouring your funds imto something and doing some money/energy work won’t pay. Using money spells

6. and positive affirmations regarding your wealth and success combined with proper education, preparation and practice is what pays off.

Creating Cash-Flow from Real Estate is simpler, (Rent Out, or Lease Option) but the risk is that your money not liquid, a bad buying decision is hard to correct.

Do you live in Spain? If not, I advise not to start in a foreign country and education is also a must!

An advice:

A good solution to increasing your income is to start/join a part time network marketing business that offers you additional training on the field of sales, communication, personality etc. It’s an exellent way to develop the skills for business, and all investing is a business, with the same fundamental structure:

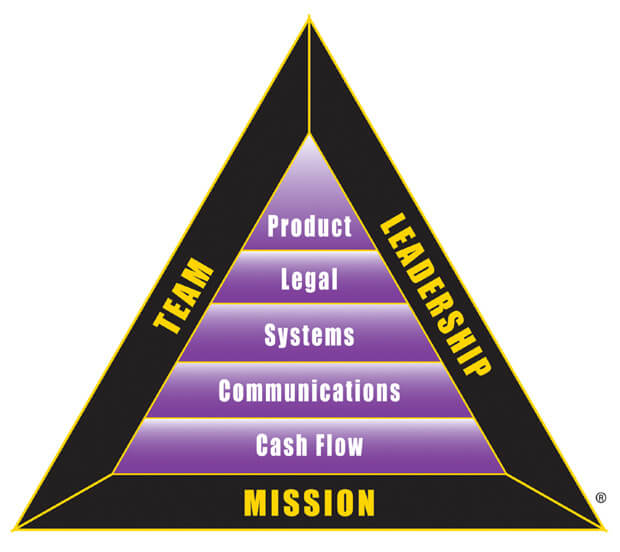

Apply this to crypto trading:

-You are the leader, the mission is to create prosperity for yourself and your beloved ones. The Team is anyone who has something to do with Crypto Trading activity: advisors, creaters of softwares you use for trading, the brokers, the staff behind the trading platform etc.

For a succesful business, Cash-Flow is the foundation. In Crypto Trading, this means that the overall trading activie brings in money. The winning trades are the income and losing ones are the regular business expenses.

-You need efficient communication with your “team” to avoid problems or to solve them.

-You need a business system, a repeatable process, that can be automated. In crypto: setting up a software, that gives you trading signals based on your strategy. This way, you don’t have to glue yourself to the monitor. Setting uo a sofware that shows you graohs about your performance, that can help in make decisions etc.

-You need legal knowledge, how to tax after your gains, what legal protection your funds and account has, etc.

-Your product in this case is the trading activity itself.

Apply the same to real estate:

-Cash Flow: The income from the rental payments should cover all the related costs and create passive income. This is the foundation

-Communicate with the people who rent your house, with anyone who works on your house etc.

-Create a system, which allows the automation of the whole process or at least spares a ajor amount of time and energy for you

-Contracts, any laws regarding real estate business and proprety

-The product is your incredible house for use at available price and fair rental policy

As a final note:

Look for seminars/webinars where you can find mentors and and learn through immersion. Investing has It’s own language and a dialect for each asset. You can learn a foreign language from a book, teacher, or by visitng the country and and immersing yourself. You learn a lot more this way.

With proper knowledge (that allows you to invest successfully) you would already know exactly what action to take. Therefore there is no point in putting money in any asset. You should first invest money into financial education, your own mind. This is the signle and best investment, that will make you rich. In the end, It’s not Real Estate, Crypto (insert any other asset) that creates wealth, It’s your knowledge about these assets, that creates wealth. Your own mind and knowledge is the real money maker.

I do not know how to thank you. You are a generous man for sharing your knowledge!

Savitar

New member

- Joined

- Sep 23, 2017